A new report from Bloomberg confirmed the launch of the Apple Card. Soon, customers from the U.S. will be able to order the new credit card.

How soon?

No later than the first half of this August.

Apparently, the most recent update of iOS supports everything necessary for the Apple Card to work and the company can slip a server-side switch to launch the card.

A few weeks ago, a Bloomberg report also stated that Apple’s retail employees signed up to the Apple Card and are testing it before it lands in the hands of anyone else.

The tech giant has established a partnership with Goldman Sachs on a credit card for U.S. customers, Goldman Sachs managing the banking infrastructure while Apple taking care of the user experience.

To use their Apple Card, users will be able to sign up directly from their Wallet app on the iPhone. Apple Card can be used with Apple Pay, along with a titanium card that works on the Mastercard network.

A list of your most recent transactions and a breakdown of your purchases by category will be available through this service. The good news is there’s no monthly fee or any hidden transaction fee when using the Apple Card. Moreover, users get 1% back when you paying with their Apple Card, 2% if they’re using Apple Pay and 3% if it’s an Apple purchase.

The cashback will go directly on your Apple Cash card and you can use this balance through Apple Pay however you want.

In terms of security, users won’t find any credit card number on the card, but when they want to pay on a website that doesn’t support Apple Pay, a virtual card number will be made available in the Wallet app.

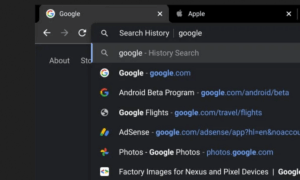

Follow TechTheLead on Google News to get the news first.