The moment you share any details online, you become susceptible to cyberattacks. Statistics indicate that 4.5 percent of U.S. residents experience identity theft each year, equating to 15 million people. The total amount of financial loss suffered goes up to $50 billion.

To help shield you from any potential damage, it’s time to start implementing online security tactics. Identity theft protection services are designed to protect you if you happen to become a target of an identity theft crime. Here are the reasons you absolutely need to invest in identity theft protection services.

Credit Monitoring

Credit monitoring services alert you when there are any updates or changes to your credit information, like your credit score dropping, the presence of a new account on your credit report, or unauthorized applications for loans or credit card using your identity.

Identity Monitoring

Identity monitoring services detect whether your identity is being used for fraudulent activity online. They basically scan the internet to find out if any of your information is leaked, is up for sale on the dark web, or is being used without your knowledge. In addition, here are a few more fraudulent activity alerts you may receive:

- A change in address to redirect your mail

- Unauthorized loan applications in your name

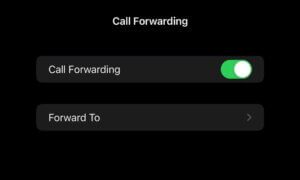

- Attempts to access and take over your bank or credit accounts

- Official records falsely accusing you of crimes

Identity Recovery

Just as the name suggests, identity recovery services help you with the damage control after you’ve been a victim of identity theft and essentially help you with the recovery process. Here are some ways they’d extend the help:

- Teach you how to repair your credit score and report from the identity theft damage

- Send your identity theft information to the credit bureaus

- Contact and work with your creditors to close the fraudulent accounts and disputes made in your name

Identity Theft Insurance

The process of damage control after the crime happens can be expensive. Identity theft insurance covers the payment of your identity recovery process. They may not be able to help you recover the money you lost, but with detailed reporting of fraudulent transactions to the law that were made using your name, you may not be responsible to pay them.

Identity Theft Protection Services

Multiple identity theft protection service providers offer features that protect and help you navigate through identity theft by giving you all the mentioned services above. Recently having partnered with Norton, LifeLock has built monitoring and alerts services along with identity restoration. In fact, their identity restoration services offer a $1 million coverage amount for lawyers and experts if needed to help fix identity theft that occurs while being a member. If you become a member now, you can take advantage of the discounts on plans they’re offering — click here for the promo offer.

Prevention Is Always Better Than A Cure

The recovery process of an identity theft crime is long, complicated, and expensive. You may end up being liable for the bills you didn’t incur. When all your information is online and readily available to steal, the only way to protect yourself is by implementation of overall online security.

Follow TechTheLead on Google News to get the news first.