Just last week, European fintech prodigy Revolut announced the launch of an app designed to let kids better manage their pocket money.

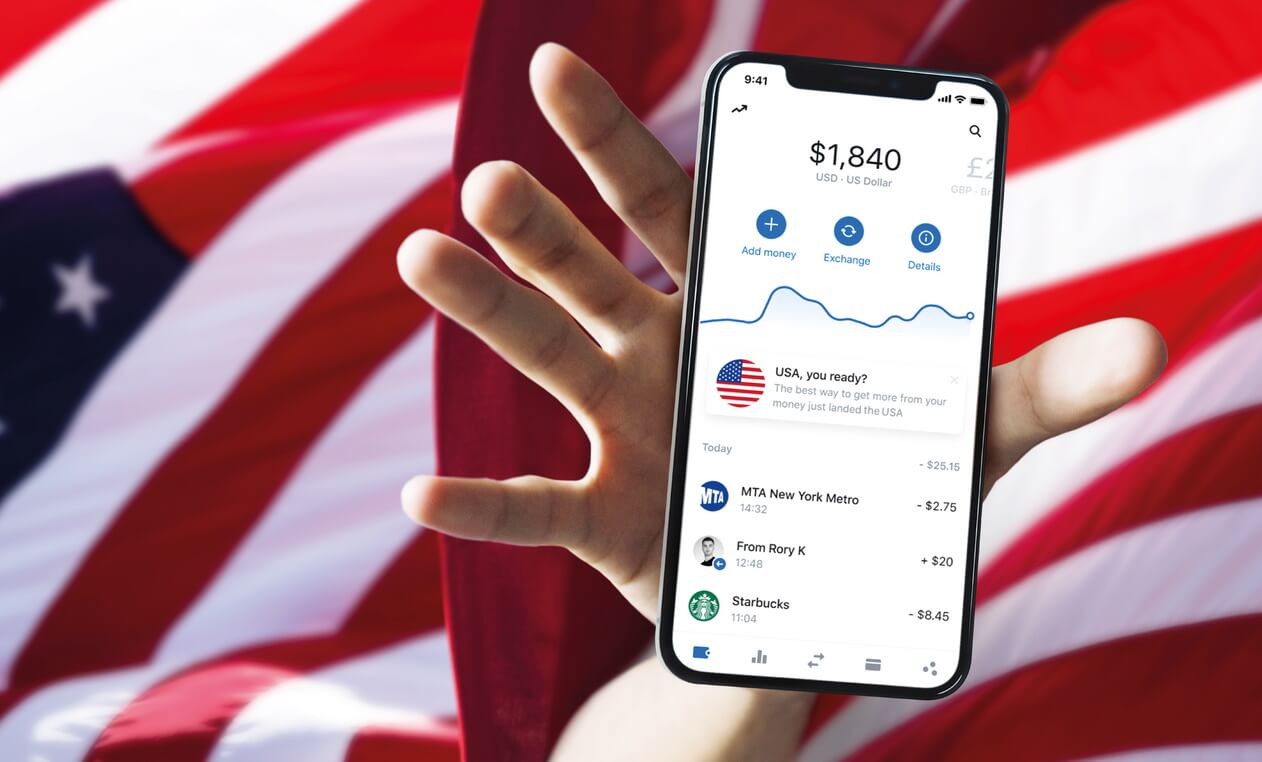

Now, the company announced it’s finally crossing the ocean and launching in the US.

To do so, it partnered with Metropolitan Commercial Bank for the infrastructure and FDIC-insures deposits up to $250,000.

In Europe, Revolut has over 10 million customers thanks to its promise to let you exchange, send and receive money from a single app, with better exchange rates than regular banks.

All an user has to do is download the app, open an account and verify your identity.

Then, you can instantly add money to your account (think PayPal) and start spending or sending online, with a physical debit card coming your way in the next few days. You control your card funds through the app and even freeze them from there in case you lose the card.

You can also generate virtual debit cards from inside the app, which is one of the nifty features behind Revolut’s popularity.

However, in the US, Revolut won’t have all the features Europeans enjoy, such as buying cryptocurrency or stocks from inside the app.

That probably will happen later, once Revolut signs up more partners.

Until then, check out their current offer here and see the announcement here.

Follow TechTheLead on Google News to get the news first.