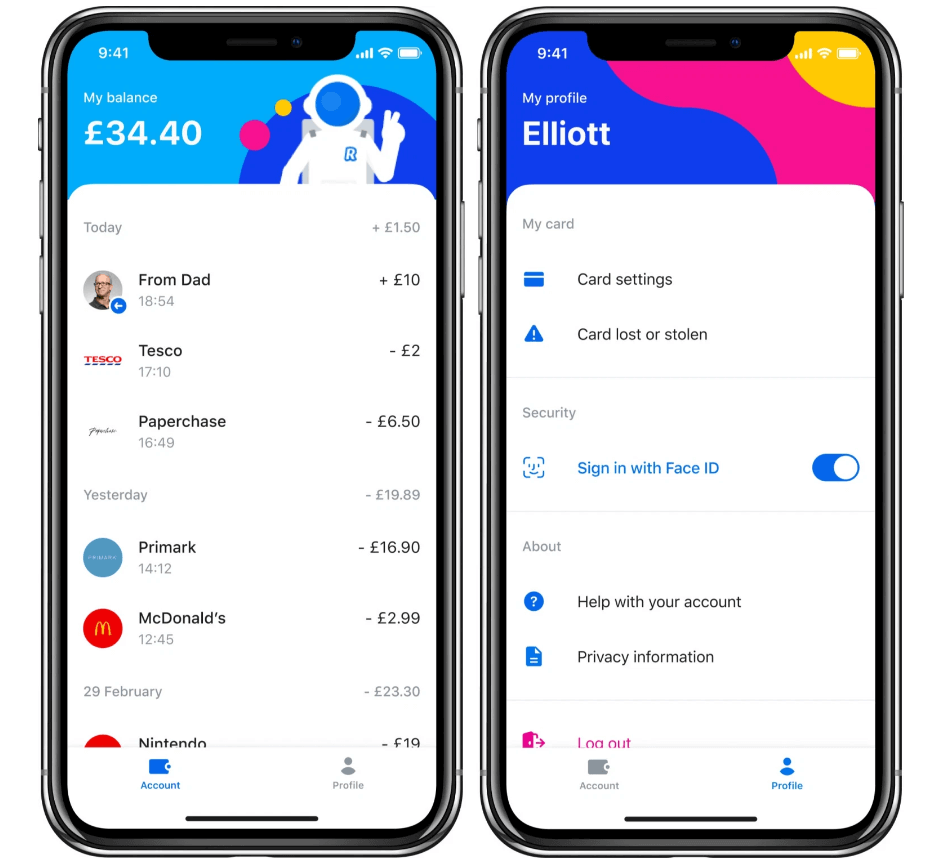

With so many areas “disrupted” by fintech, pocket money for kids seems to be the next one in need of an overhaul.

The online bank Revolut just introduced Revolut Junior, an app that integrates directly with the main Revolut App and lets parents manage their kids’ finances with a few taps.

To do so, they create a Revolut Junior account.

Then, the kids download the app and receive their own Revolut Junior card, but the parents hold all the cards.

Any child aged between 7 and 17 can receive a card and their pocket money from their parents on it, but parents maintain full control over what they do.

They get access to the full balances, can opt to receive notifications when the child uses the card and can block online payments to make sure they don’t spend it all in one place (like Fortnite).

“Sounds great so far? We hope so, but Revolut Junior is more than just a pocket money account.

It’s a way for kids to learn about saving and budgeting — because let’s be honest, they’re not learning it in school!,” said the company in a blog post.

The Revolut Junior service is now available in the UK only to Premium and Metal Revolut users but the company will expand it in more countries soon enough.

Follow TechTheLead on Google News to get the news first.