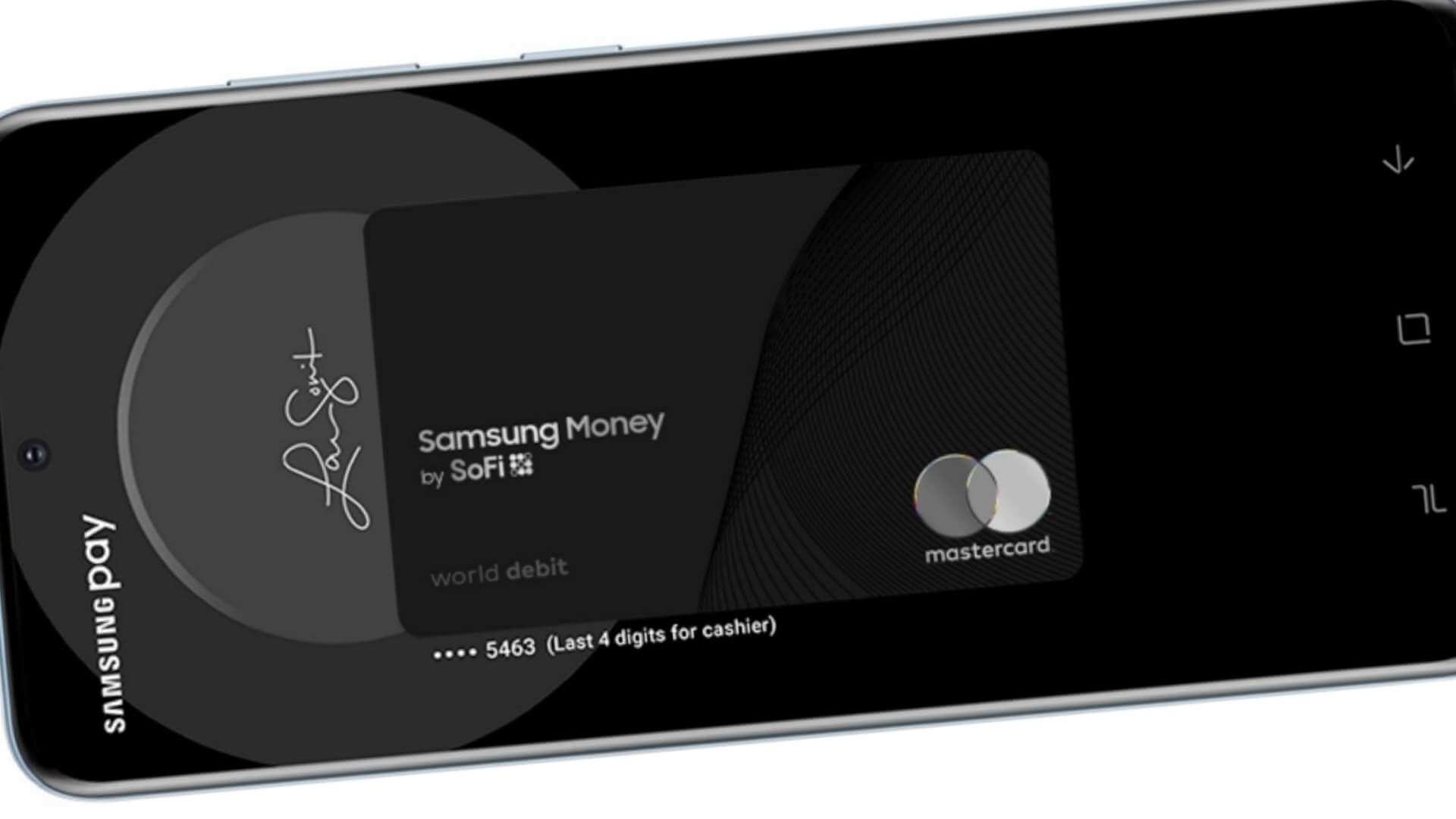

The new debit card and cash management from Samsung, in collaboration with SoFi, called Samsung Money, seems to be an interesting proposal if you look at it from a comfort point of view.

The user can manage finances and debits from the Samsung Pay app, but the card is available only to Galaxy users from the S6 and up. This limits the pool of potential clients for the Samsung Money, but it also provides long time fans with a way to manage their cash from one device. Some Galaxy wearables can access Samsung Money, with updates to the app and new device compatibility coming sometime in the future.

What makes Samsung Money so special, is the fact that the company wants the debit card to have no account fees. This can be subjected to change, according to the company’s post but, at the moment of the writing of this article, it has no account fees.

Another great feature is the fact that the moment you get accepted for the service, you get a digital functioning version of the card on your phone. The physical version of Samsung Money will be shipped to you on a later date, so you have more than one method to spend your cash.

According to Samsung, the physical version of the debit card will not have any account number or CVV characteristics inscribed on it. This is done to provide an extra layer of protection for the user while also encouraging them to use the Samsung Pay app. The Samsung Money is issued by The Bancorp Bank, and the South Korean company partnered with Allpoint to provide users with ATM access to 55,000+ ATMs within the network.

The Samsung Cash Management System seems like the way to go here, provided that the company keeps its promises and holds true to these, to provide a point system, no account fees, and an extended warranty. All these, of course, if you are an avid Galaxy user.

For the Samsung Pay ecosystem users, the company offers for a limited time, a way to convert Samsung Rewards points into cash. But you will need an active account with a minimum balance of 1,000 reward points to be eligible.

Another interesting trivia is the fact that the cash balance in Samsung Money accounts is linked to one or more banks that are in the program, where it earns a variable rate of interest and is eligible for FDIC insurance. Although, the FDIC Insurance does not immediately apply and begins when the funds arrive at a program bank.

There is also a waitlist involved with this new feature, you can sign up in the Samsung Pay app or on their website.

Follow TechTheLead on Google News to get the news first.